Seasoned investors are loading up on altcoins – as many are trading at huge discounts from their prior all-time highs. There are thousands of altcoins to choose from, each offering its own upside potential, risks, and unique selling points.

In this guide, we reveal the 14 best altcoins to invest in right now. We cover a broad range of altcoin markets, including small, medium, and large-cap projects.

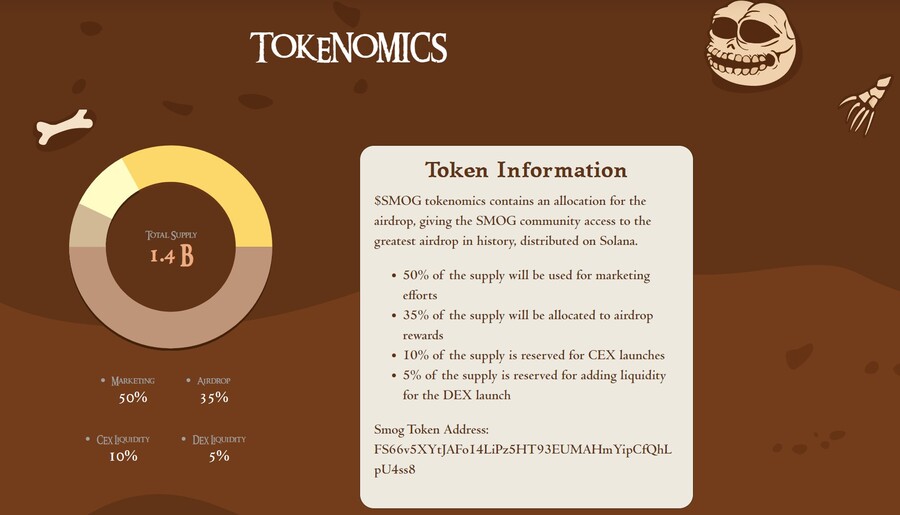

Listed below are the 14 best altcoins to invest in for 2024: Seasoned cryptocurrency investors will typically buy a wide range of altcoins. This will reduce the risks of investing in an altcoin that fails to increase in value. It also increases the odds of choosing an altcoin that generates huge returns. We have selected the 14 top altcoins for 2024 and each is reviewed in the following sections. Smog is the latest token in the meme coin frenzy on Solana, following the success of Bonk, Dogwifhat and Myro. With 50% of the total token supply dedicated for marketing uses and 35% for token airdrops, Smog has a massive potential to outperform its meme coin peers. To earn a portion of the 490 million tokens that will be airdropped, you need to hold $SMOG tokens in your wallet to earn airdrop points. Earn more points by completing quests in the accompanying Zealy campaign. You need a Solana wallet to buy and hold $SMOG. Choose from Phantom, Solflare or Backpack, and add some SOL coins for transaction fees. Connect the wallet with Jupiter, which is the largest aggregator on Solana and use SOL, USDC or USDT to make the purchase. You are now part of the project and eligible for the airdrop. Given that 85% of the total token supply is set aside to bring hype to this project, this could be the best altcoin to buy now. Lear more about this altcoin in the Smog whitepaper. Also, follow Smog on X and join the Smog Telegram channel for the latest information.

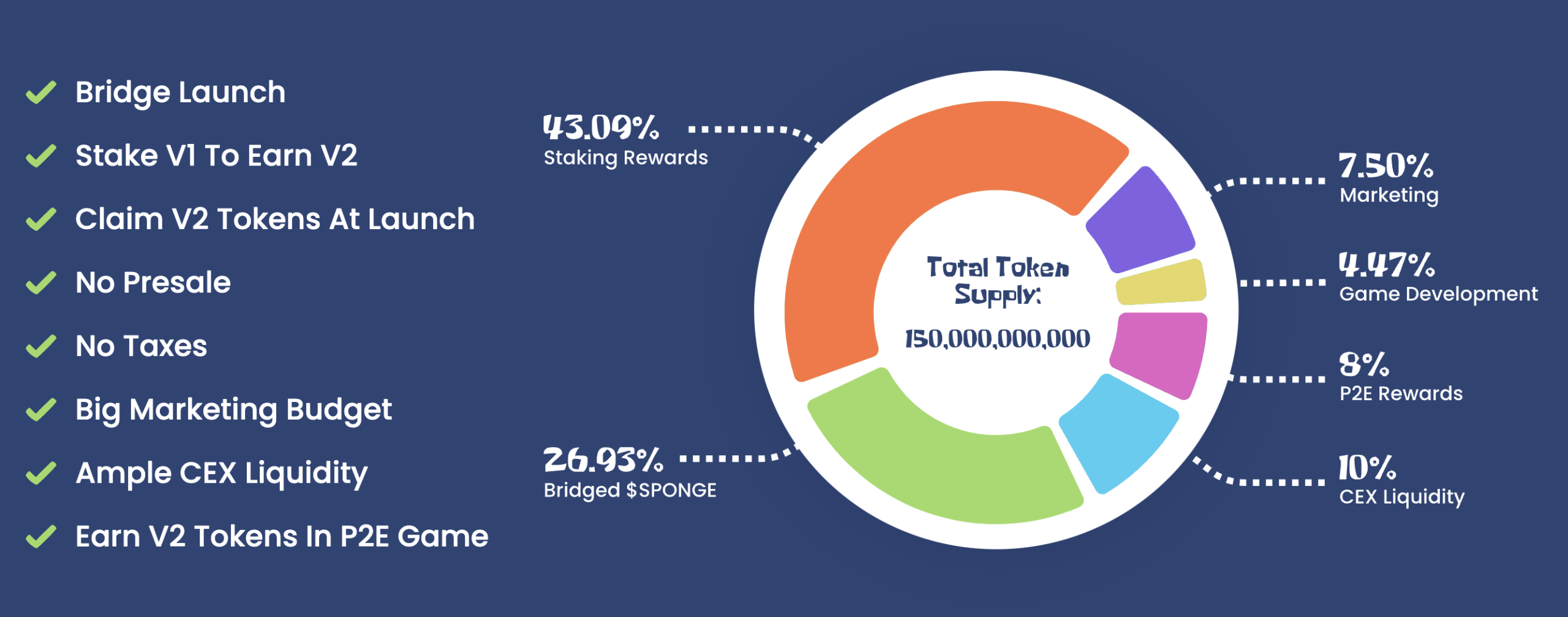

In summer 2023, $SPONGE saw a significant upswing, leading to remarkable success. Launched in May, the meme token capitalized on the public’s affection for the cartoon, achieving a market cap of $100 million. Although its value later decreased, the launch of $SPONGEV2 aims to revitalize the community. Transitioning to $SPONGEV2 tokens uses a stake-to-bridge approach, but first, original $SPONGE token holders need to withdraw their stakes before the existing pool closes. These withdrawn tokens can then be staked in the new V2 smart contracts, where staking rewards come in the form of $SPONGEV2. Important to remember is that once $SPONGE is staked in the V2 contract, this move is permanent, and your stake will be in $SPONGEV2. Choosing to stake in V2 offers the prospect of high Annual Percentage Yields (APYs) for the next four years. Currently, there are over 400 million tokens staked in the V2 contract, potentially offering annual yields up to 4,000%. Enhancing its attractiveness, Sponge’s forthcoming play-to-earn racing game, detailed in the whitepaper, is slated for release following the V2 tokens. This game introduces an additional method for token holders to accumulate $SPONGE tokens through participating in online gaming competitions. Explore Sponge on X, Telegram, and Discord to stay informed about the V2 release and to learn about the benefits of token staking.

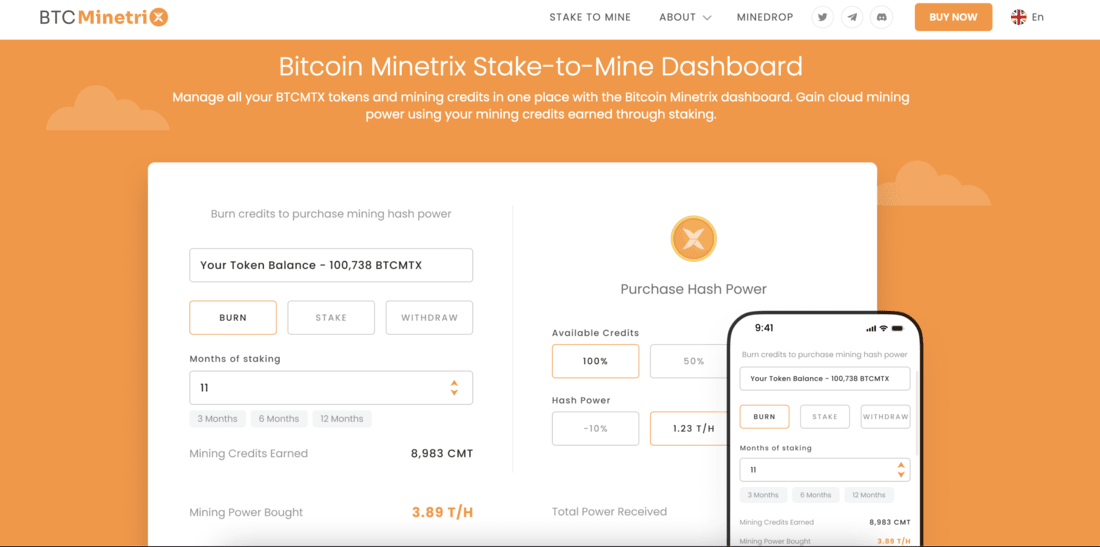

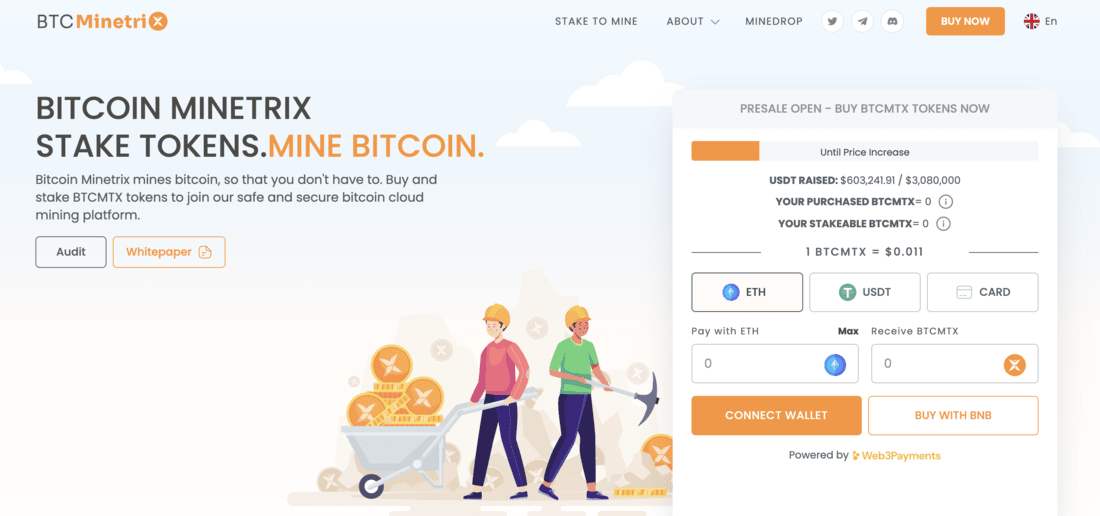

Bitcoin Minetrix (BTCMTX) is a brand new altcoin with a focus on the Bitcoin cloud mining industry. After conducting our research, we listed it as number one for quite a few reasons. From an investment perspective, the coin trades at a discount, at just $0.011 in the first of its 10-stage presale. Bitcoin Minetrix targets the Bitcoin mining and Bitcoin cloud mining industry, both of which have their flaws. Bitcoin mining is dominated by large, centralized mining agencies with huge resources, running environmentally destructive hardware servers. Bitcoin cloud mining is known for scams and dishonest service providers, with changing terms and conditions, along with high upfront costs. In contrast, Bitcoin Minetrix offers cloud mining for $10, using Ethereum smart contracts, with a simple and easy-to-use interface. Through non-transferable ERC20 mining tokens, the owner retains full control of the operation and can manage their earnings from an intuitive interface. This is the world’s first stake-to-mine model, and a mobile application is also under development, for 24/7 passive income on the fly. Users can decide to burn or to stake, two primary means of ROI aside from the price appreciation potential. Some analysts have tipped this as a 10x or even 100x altcoin in 2023. This is mainly due to its utility value as it provides a genuine way to clean up the Bitcoin mining and Bitcoin cloud mining industry, using Ethereum smart contracts. It has further conducted a smart contract audit from a reputable third party, with stellar results. For more information, investors should read up on the Bitcoin Minetrix Whitepaper. The project socials are also useful sources of information – Twitter and Telegram.

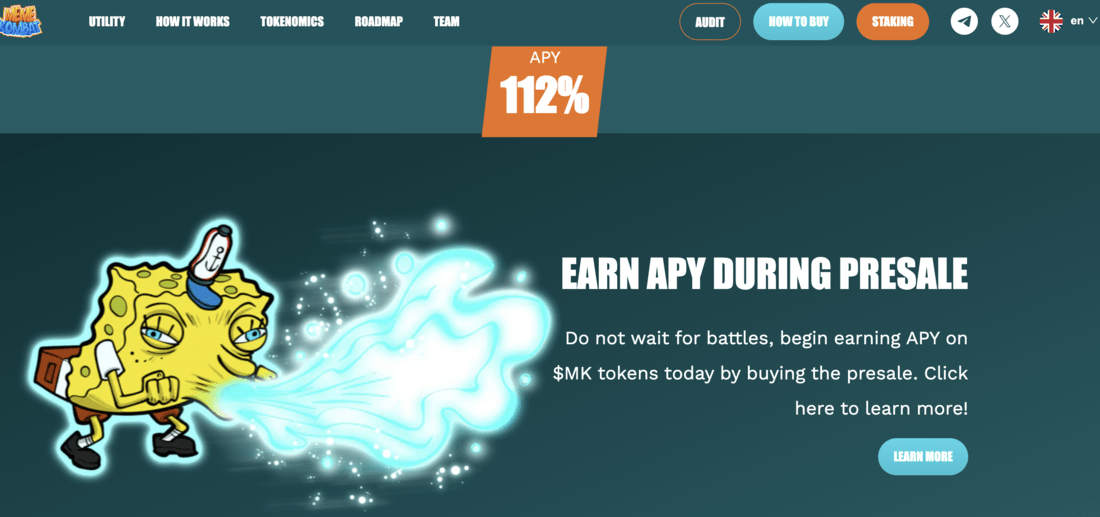

Meme Kombat ($MK) is an ERC20 altcoin that provides a steady 112% APY to users, as well as the ability to earn income from wagering on fights between the world’s most famous meme icons. There are three primary betting options in this new platform – P v P, P v Game, and Direct. But it also adds novel side bets, akin to the many betting options available in modern casino industries. It is expected to increase its betting variety, as well as the combat styles, after the first season concludes. Fight outcomes are processed on the blockchain, with automatic distribution of rewards for increased transparency. This is a highly transparent project, as the founder has revealed his identity and can be viewed on sites such as LinkedIn. Coupled with the fact that this project is smart contract audited and that the team has not kept any of the token allocation to themselves, it scores top marks in terms of its transparency. There are two main reasons why we love this altcoin. The first is that it brings memes together under one architecture. Meme coins are known for massive hype and rewards – but combining them together with live betting on the outcomes could have even more potential, as such coins have gigantic followings. This is something completely new within the memecoin space. The second reason is transparency. The problem with meme coins is that they can be volatile and untrustworthy, but this is not a concern with this altcoin, having a doxxed founder, clear token allocation, and smart contract audit. For these reasons, it could perform exceptionally well in 2023, maybe even reaching 100x, or a more modest 10x, upon exchange listing. The token price is just $1.667 and there are a total of 6 million tokens available in the presale, for a $10 million hardcap. Further information can be obtained from the Whitepaper, as well as the project socials – Telegram and Twitter.

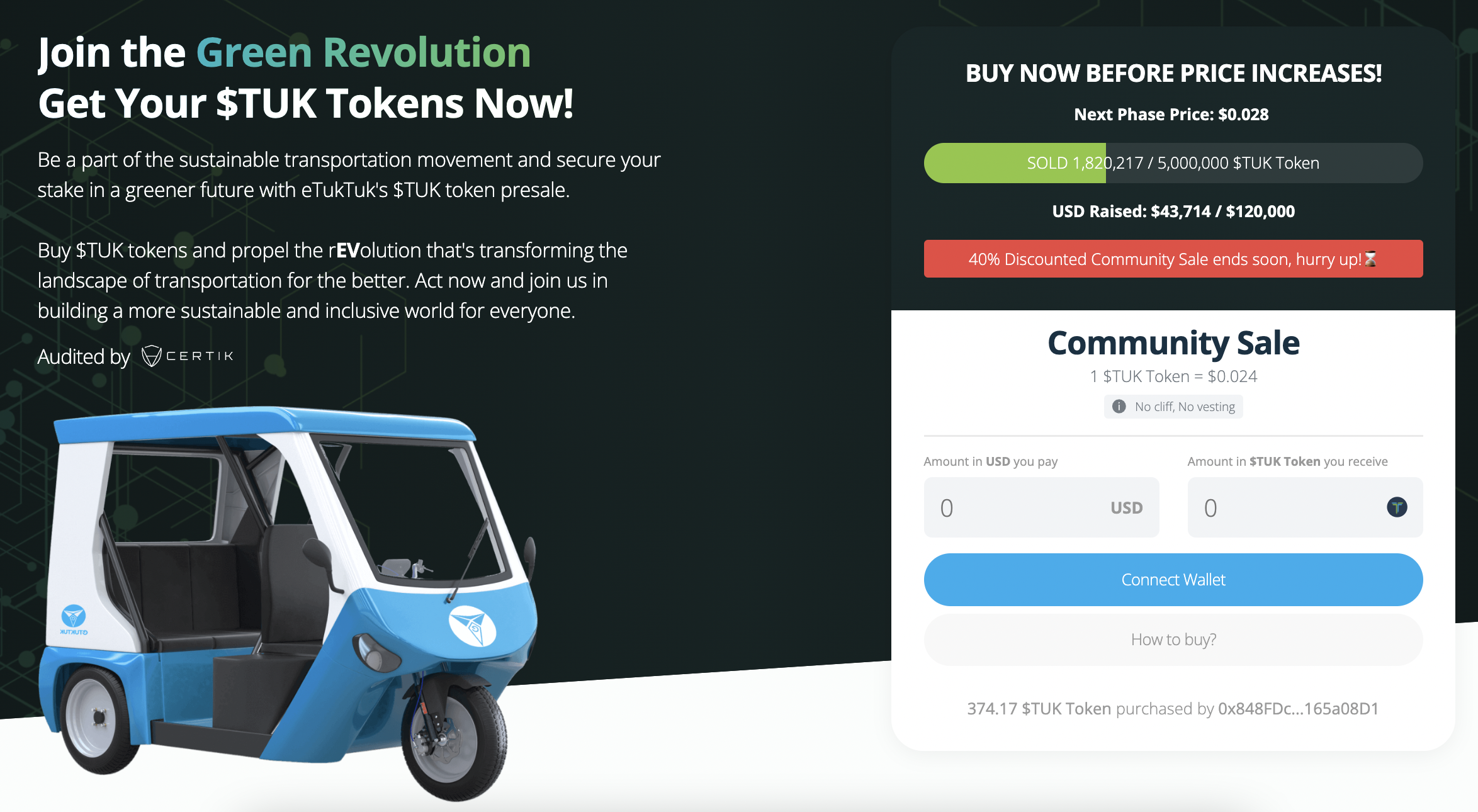

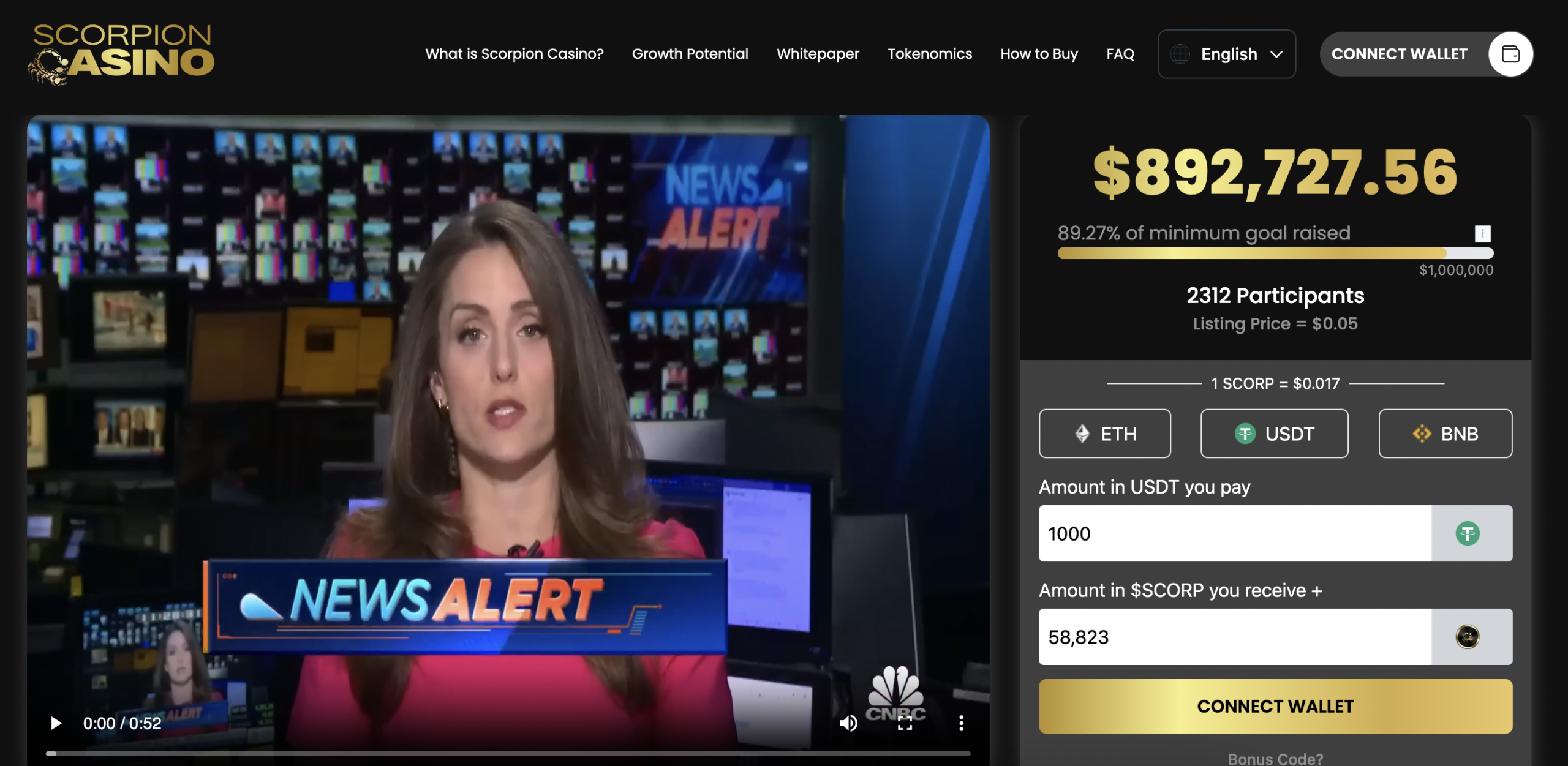

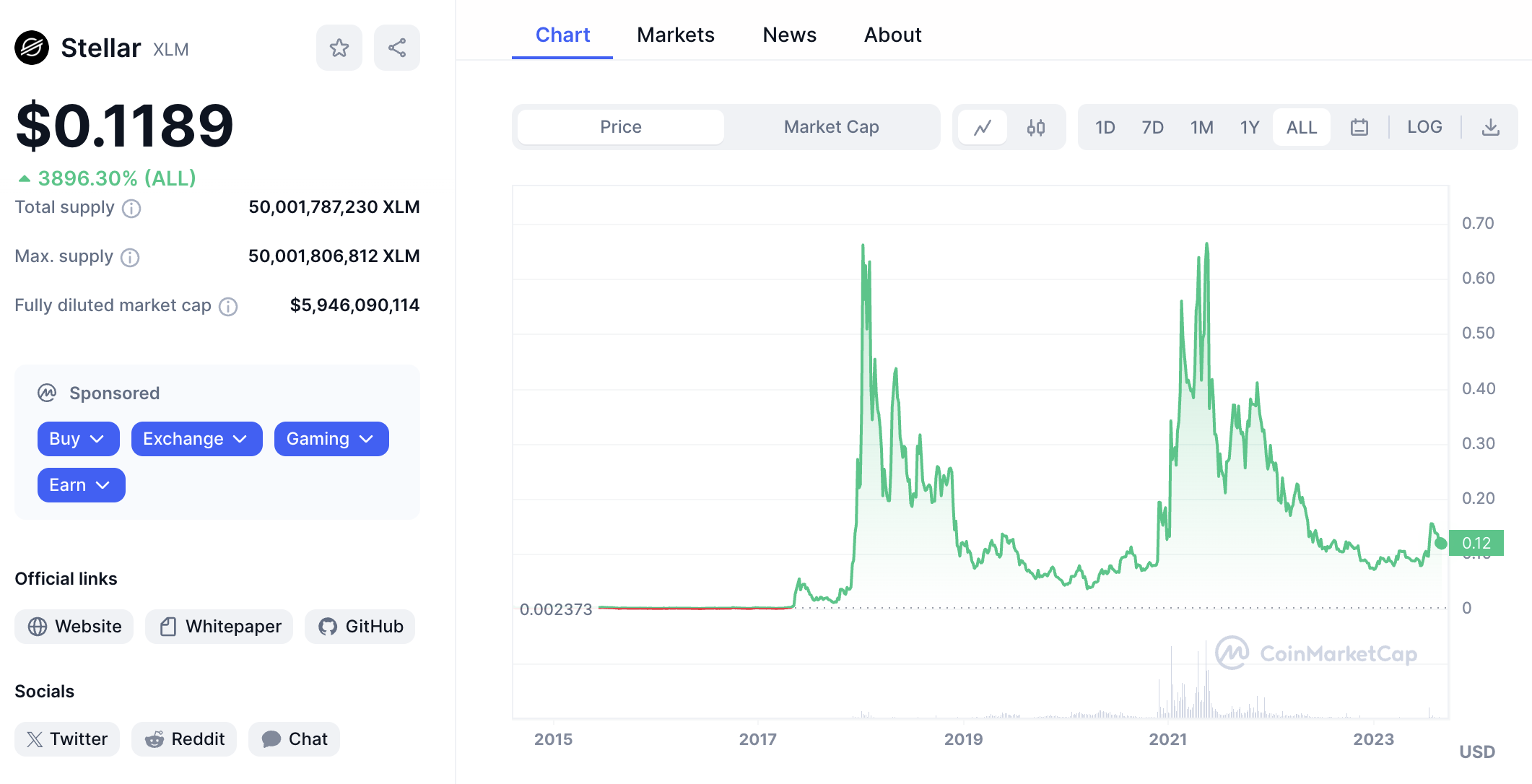

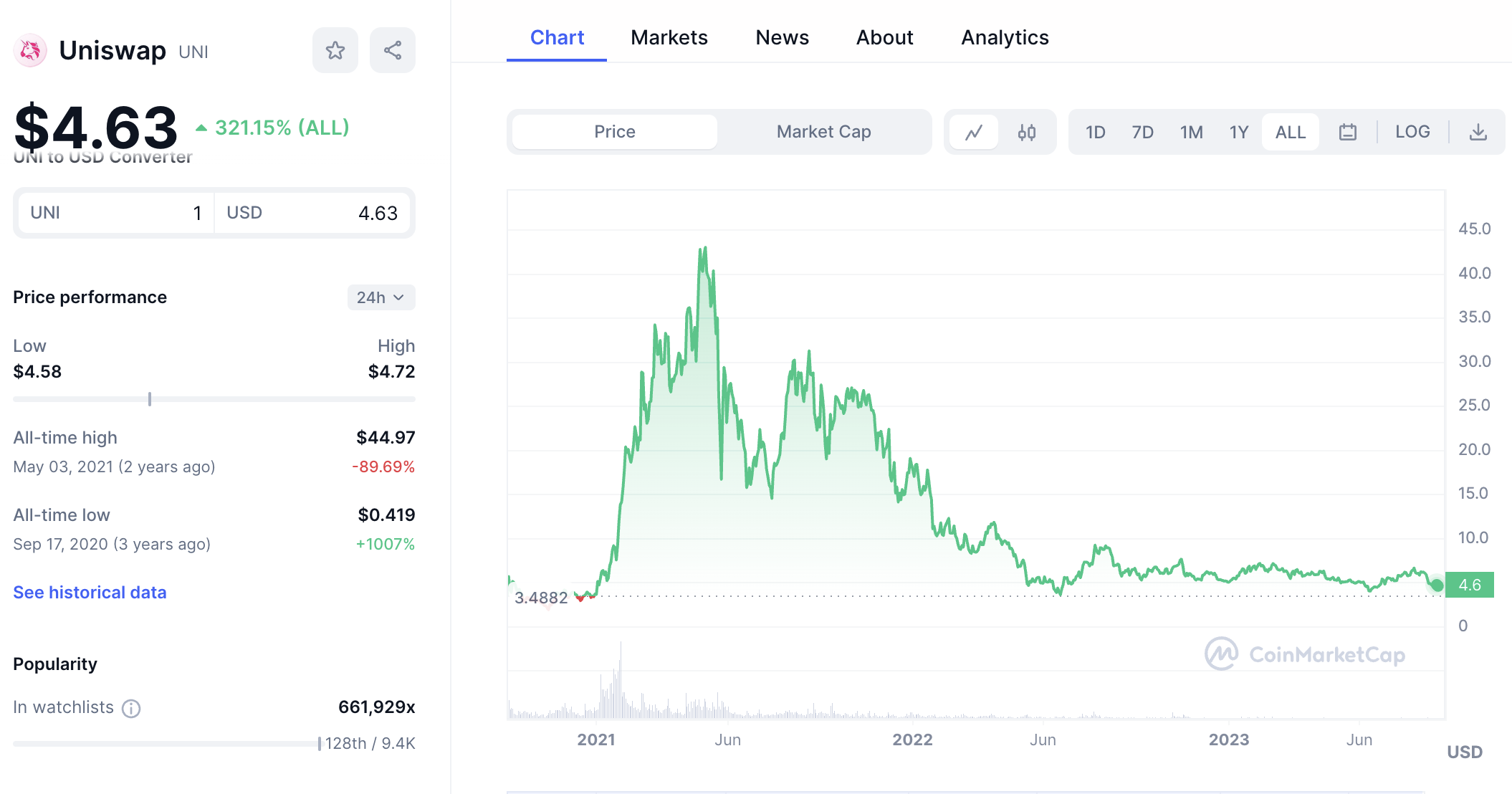

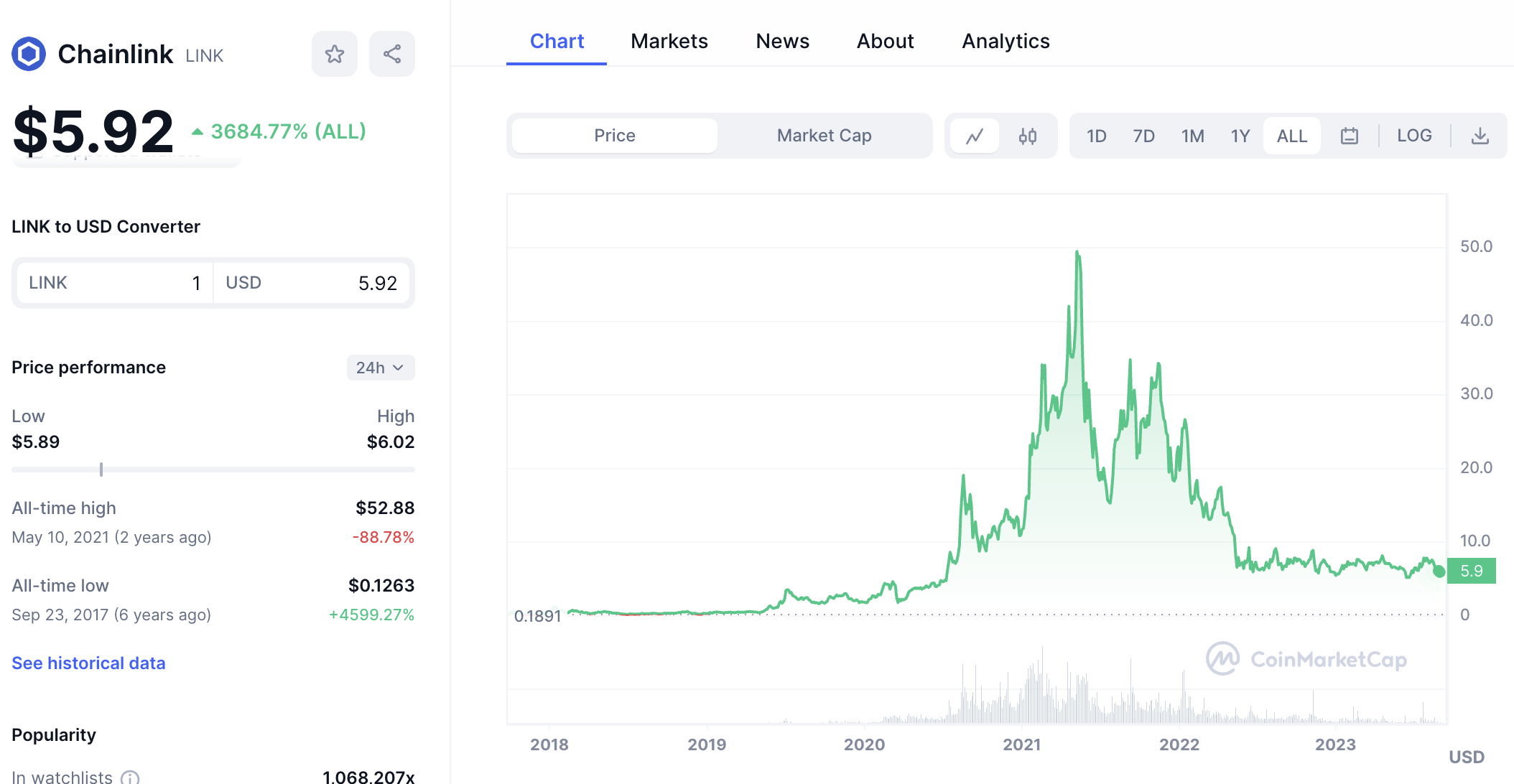

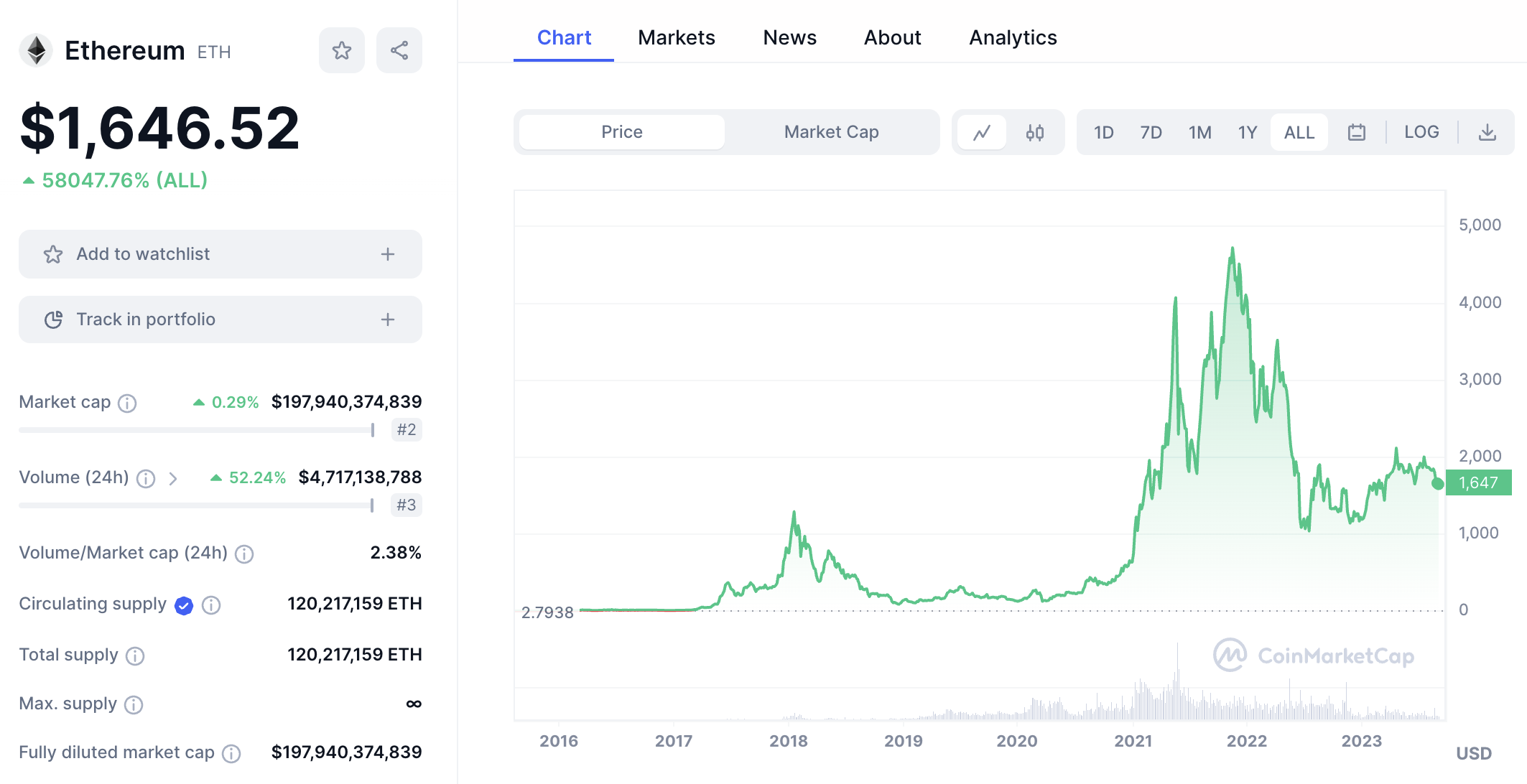

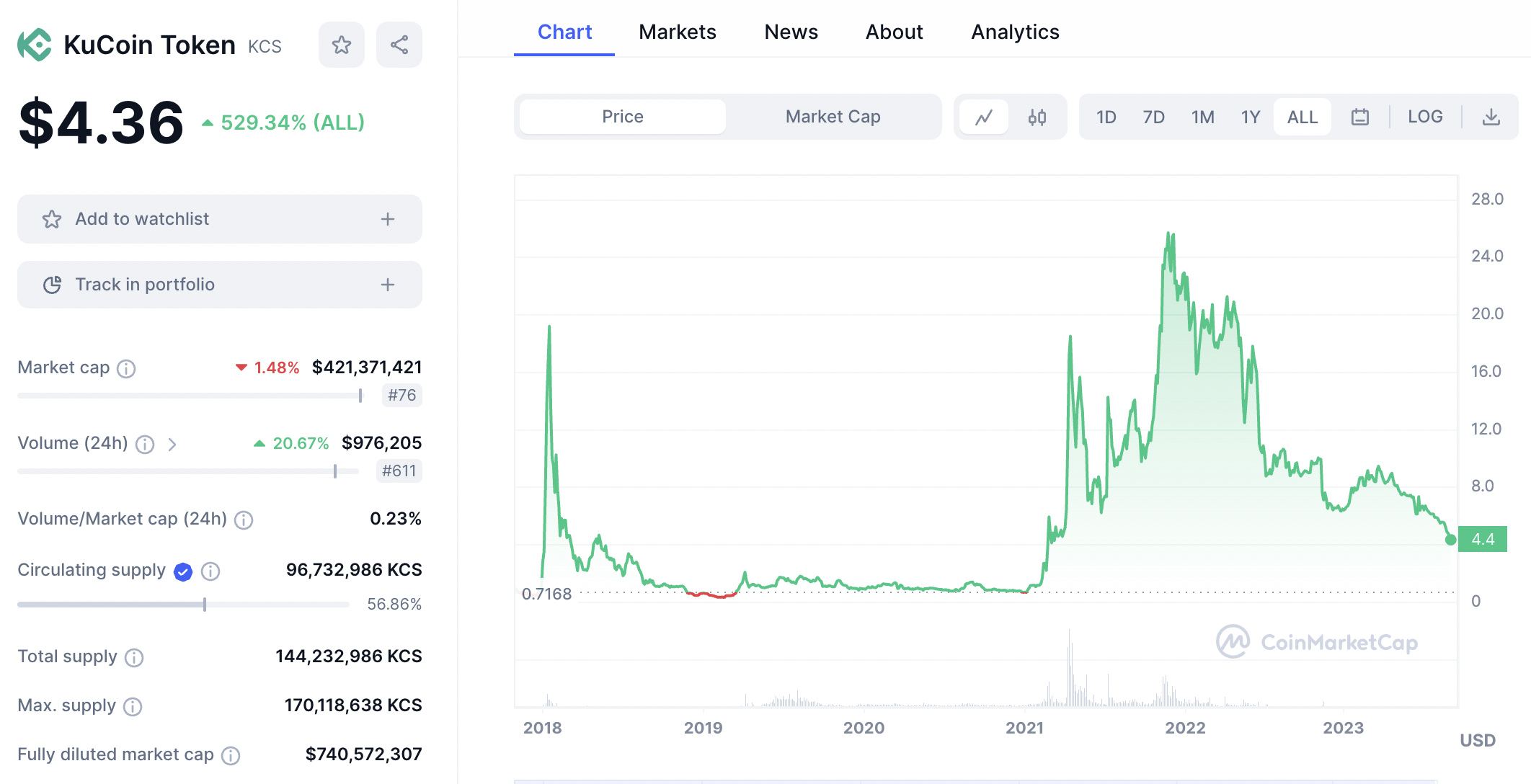

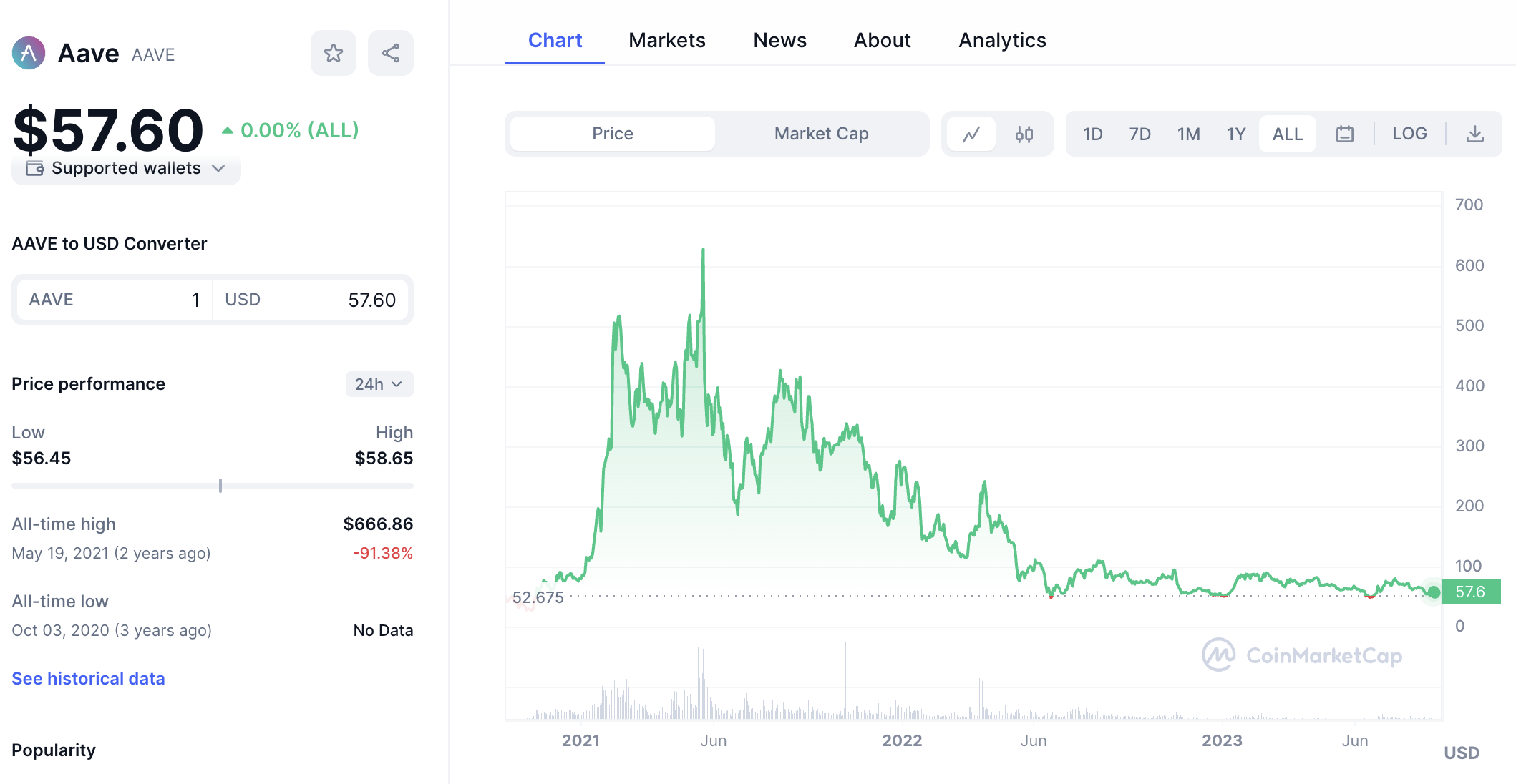

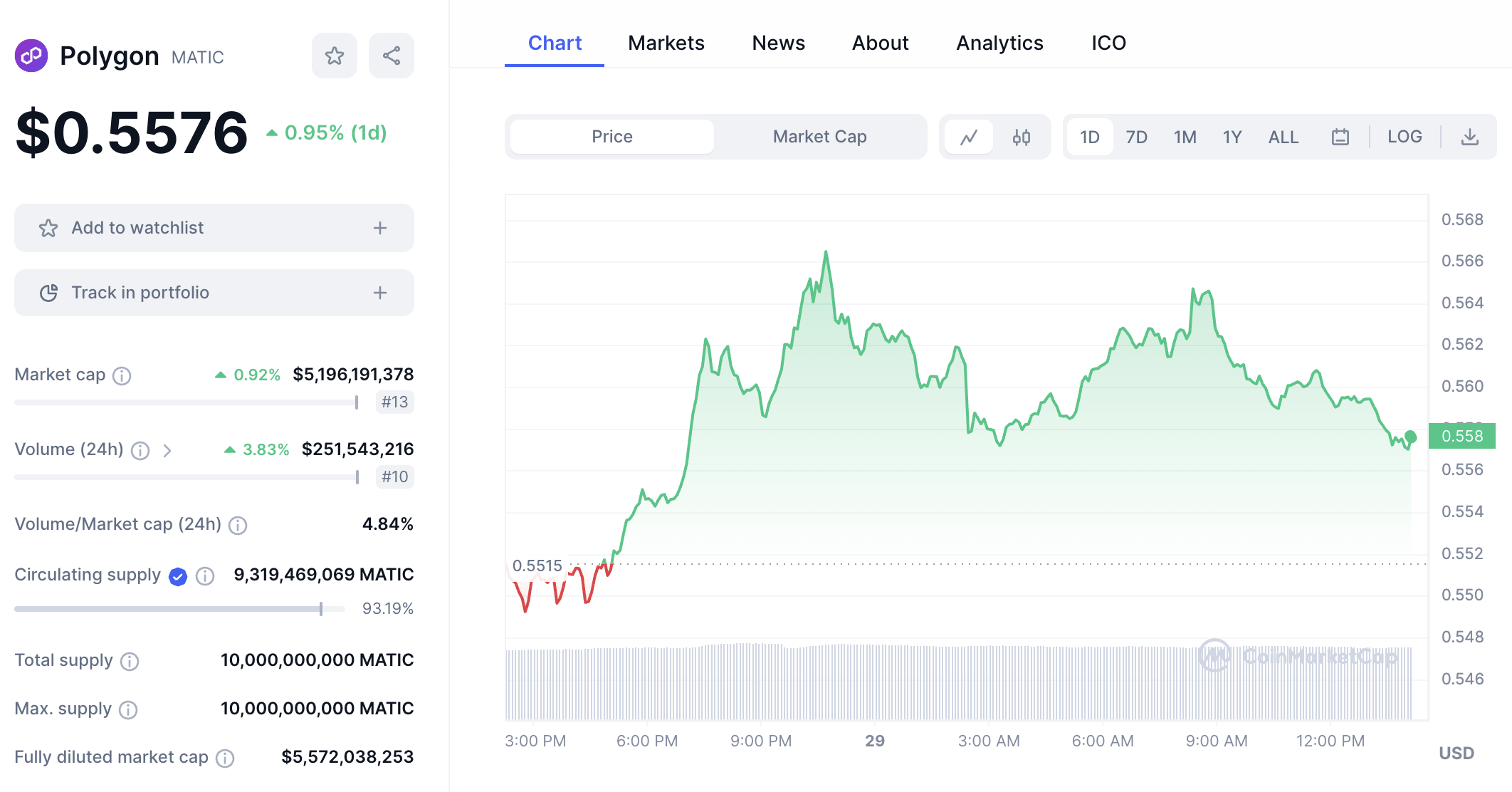

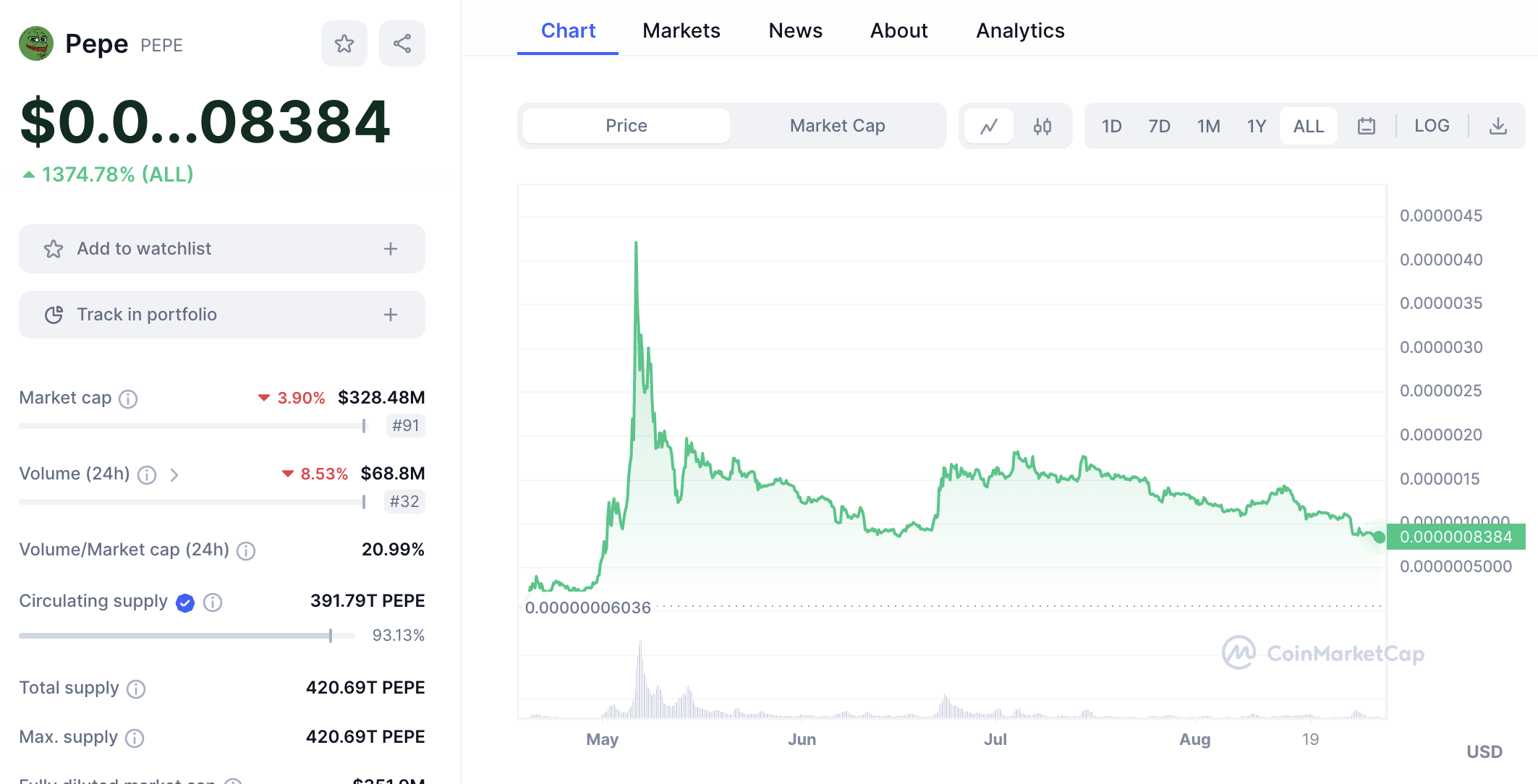

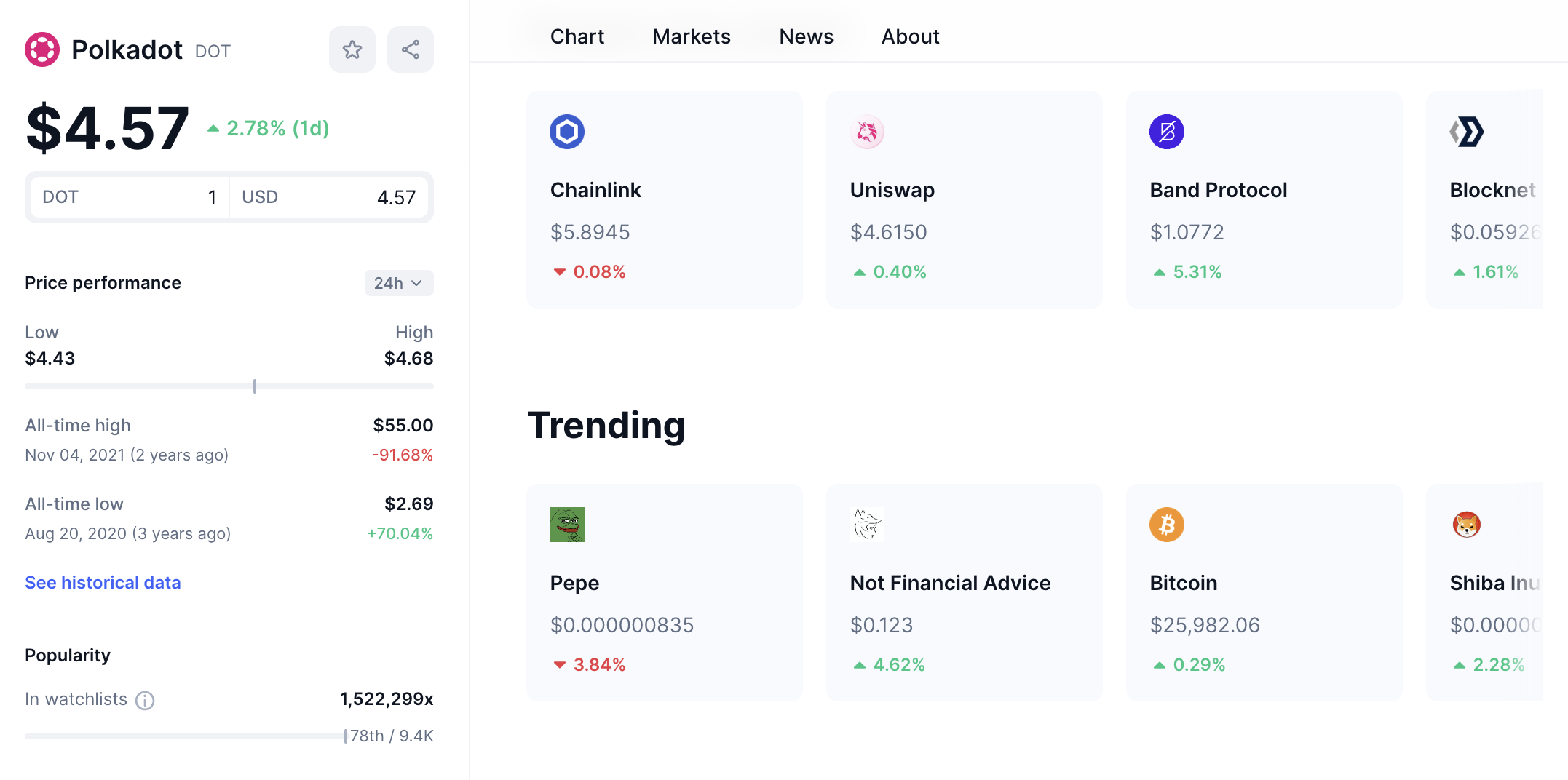

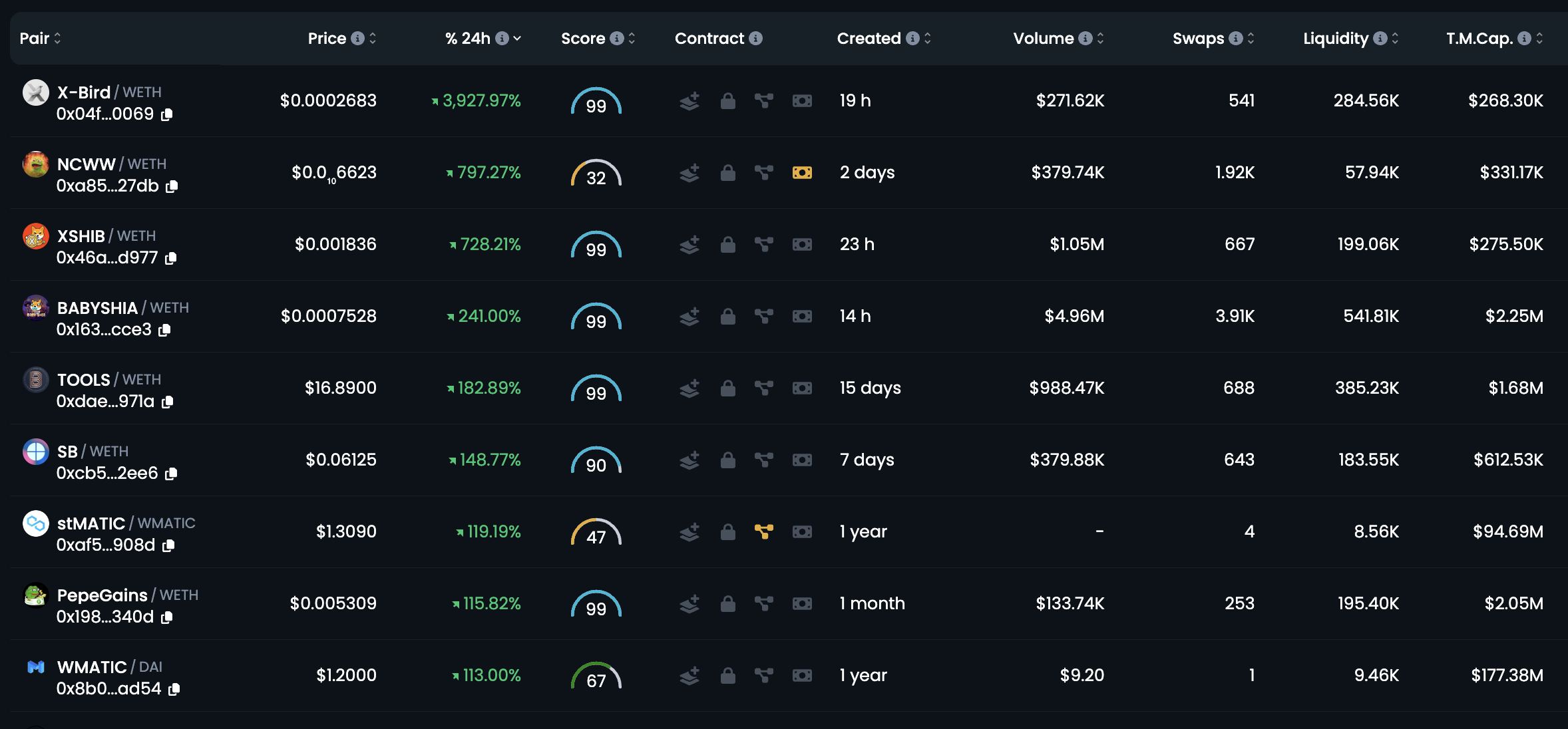

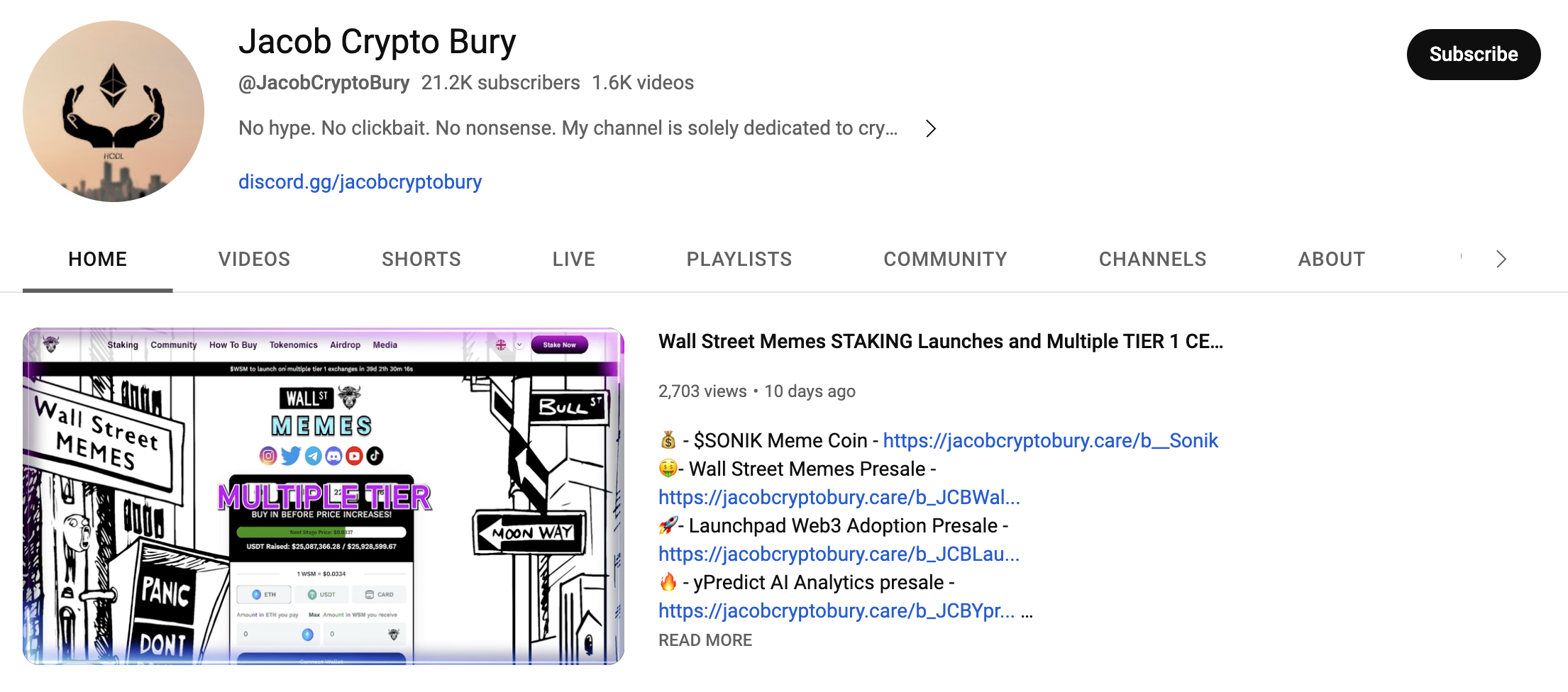

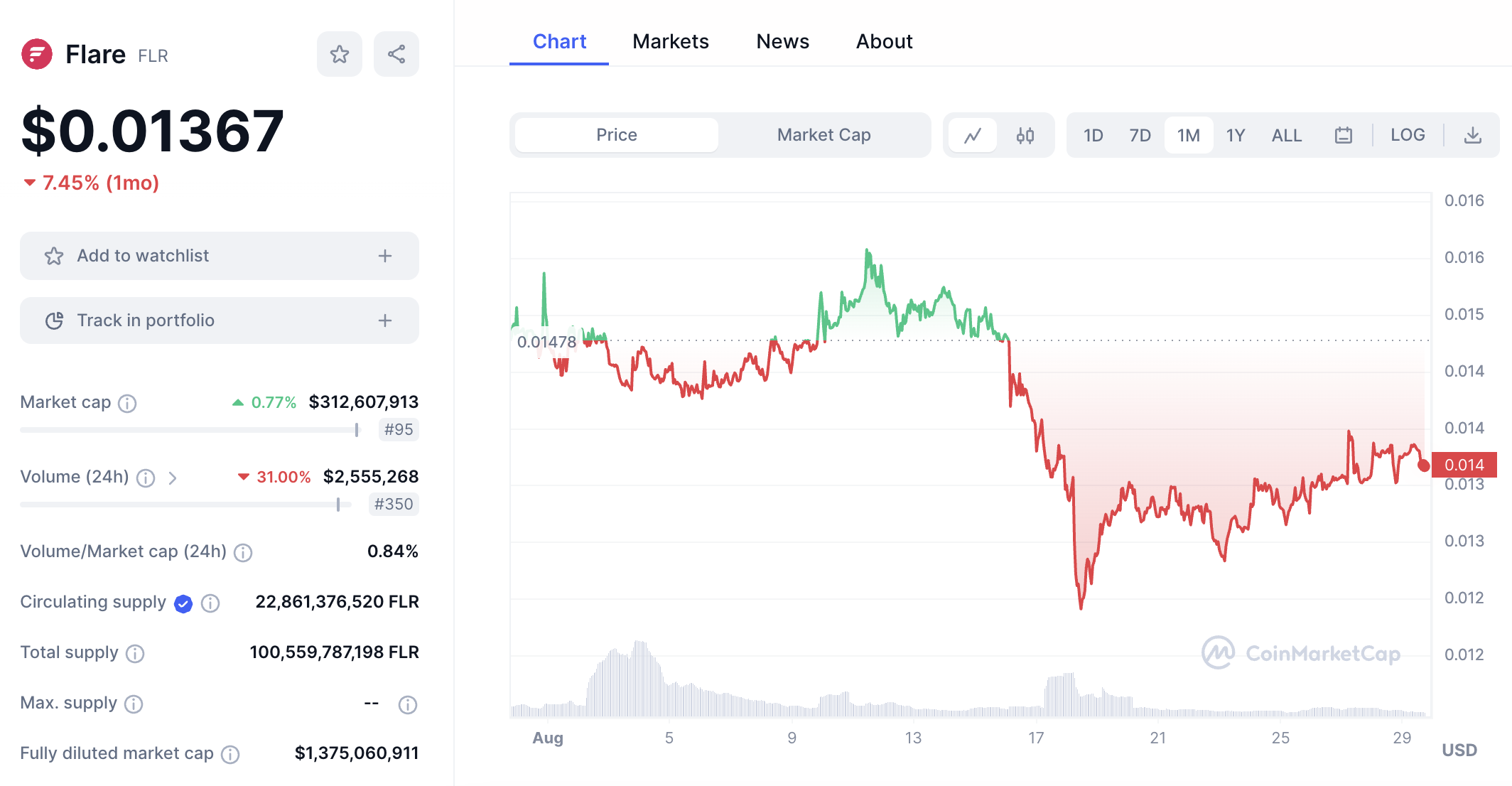

eTukTuk has ambitious but highly achievable goals – it wants to revolutionize the transportation industry in developing countries. More specifically, it wants to help tuk-tuk drivers in Asia and Africa go from internal combustion engines (ICE) to electric vehicles (EVs). After all, as reported by the Guardian, there is rising demand in Thailand and other developing countries for green alternatives. From a cost perspective, eTukTuk makes tuk-tuk transportation more affordable. Not only in terms of purchasing tuk-tuks, but EV charging is a lot cheaper than traditional fuels. This is especially the case with ever-rising oil and gas prices. Moreover, eTukTuk vehicles are significantly better for the environment, and society as a whole. The eTukTuk whitepaper also claims that its tuk-tuks will be built using sustainable materials. It notes that this will create jobs in local communities, so it’s a win-win situation for all stakeholders. eTukTuk will also be implementing blockchain technology into its ecosystem. This will offer increased transparency and the ability to track carbon emission offsets. TUK tokens will sit at the heart of its network and can be used as a payment method for drivers and passengers. Those looking to gain exposure to eTukTuk can invest in its recently launched presale at a 40% discount. Another way to diversify your altcoin investment is to explore the gambling industry – Scorpion Casino fits the bill here. This is a brand-new crypto casino and sportsbook that offers many benefits to players. For instance, unlike traditional gambling providers, Scorpion Casino does not ask for personal information or KYC documents. Moreover, it offers speedy payouts that take minutes – not days or weeks. Players will also like Scorpion Casino for its huge welcome bonuses; up to 1.1 BTC is available to first-time customers. But Scorpion Casino won’t only appeal to gamblers – it’s also behind one of the best altcoins to invest in for 2023. The SCORP token backs its casino and sportsbook, and investors can make a purchase at presale prices. In fact, the Scorpion Casino presale is currently priced at $0.017 per SCORP. After the presale, SCORP will be traded on exchanges at $0.05. As a result, the current presale price offers an upside of 194% and has already raised $900k. That said, the upside can only be realized if the listing price holds – this can’t be guaranteed. Nonetheless, extra perks are available for those investing in the presale today. This includes a 40% bonus, payable in casino chips. Presale investors will also be entered into the Scorpion Casino giveaway; this comes with a huge prize pot of $250,000. Stellar is one of the best altcoins to invest in for long-term growth. This altcoin project has developed a proprietary payments network that supports cross-border transactions. It is particularly useful for sending remittance payments to friends and families. After all, Stellar charges just 0.00001 XLM per transaction. Currently prices at just under $0.12, this converts to a transaction fee of $0.0000012. This also makes Stellar suitable for micro-payment transfers. That said, Stellar is also ideal for companies that have a cross-border presence. It’s currently being used by IBM for internal transfers that require more than one currency. Moreover, Stellar is being used by MoneyGram for more efficient and speedy payments; in most cases, transactions take about five seconds to process. In addition to the fundamentals, Stellar is one of the best altcoins for securing a bear market discount. Stellar is trading 87% below its all-time high. Uniswap is one of the best altcoins to buy for exposure to decentralized trading. Put simply, its platform allows users to buy and sell tokens without a centralized party. It uses automated market maker (AMM) technology for this purpose. AMM uses liquidity pools to facilitate trades, so token swaps can occur without another market participant. Uniswap liquidity pools are funded by investors who want to earn passive income on their idle tokens. Yields are generated by trading fees, collected by the respective pool. Another feature of Uniswap is that it supports cross-chain token swaps. For instance, users can swap BNB for USDT or Dai for ARB. Uniswap has a proprietary ecosystem token, UNI. Uniswap launched its token in late 2020 at just over $3.4. It’s currently trading over 320% higher. However, at current prices, UNI tokens are trading 90% below their all-time high of $44.97. This is another example of a top-rated altcoin that offers a juicy bear market discount. Chainlink is an innovative blockchain project and one of the best altcoins to invest in today. It specializes in “Oracles’. In simple terms, Oracles provide smart contracts with real-world data. Crucially, without Oracles, smart contract networks like Ethereum and Solana would not be able to extract data outside of their respective blockchains. Consider this use case; Suppose a smart contract is programmed to pay a sports bet out as soon as the game finishes. Via Chainlink Oracles, the smart contact can verify the score of the game in real-time. The Oracles will use multiple data sources to ensure the result reaches a consensus. After feeding the smart contract, the smart contract settles the bet. This is just one example of how Chainlink bridges the gap between the real and virtual worlds. Other industries that could be revolutionized by Chainlink include healthcare, supply chain, insurance, finance, and trading. LINK, the project’s native token, has a market capitalization of over $3 billion. At current prices, LINK can be bought at a discount of almost 90%. Ethereum is the largest altcoin for market capitalization and is currently valued at over nearly $200 billion. This means that Ethereum attracts plenty of liquidity and trading volume, giving your altcoin portfolio some much-needed stability. Ethereum has solid fundamentals and it is the leading blockchain for decentralized applications (dApps). Thousands of dApps operate on Ethereum from a variety of niches and markets. For example, we mentioned earlier that UniSwap is built on Ethereum; every time a trader buys or sells a token, this triggers an Ethereum smart contract. In turn, the trader will need to pay transaction fees in ETH. This is just one example of how ETH remains in high demand with dApps. According to DeFiLlama, Ethereum has a TVL (Total Value Locked – the combined value of products built on it) of more than $22 billion. That makes up more than 57% of the total market and is more than four times higher than its nearest competitor, Tron ($5.35 billion) Crucially, building dApps on the Ethereum network is seamless. Its network provides thousands of ERC20 tokens with a secure and decentralized place to operate. This includes metaverses, decentralized exchanges, play-to-earn games, Oracles, gambling sites, and much more. Ethereum can be purchased today at a bear market discount of 65%. KuCoin Token backs the crypto exchange of the same name. It’s one of the largest exchanges in the market, with over 29 million registered users from more than 200 countries. In addition to spot trading, KuCoin supports derivatives, savings accounts, staking, and a launchpad for new cryptocurrencies. Naturally, KuCoin Token offers exposure to the growth of the KuCoin exchange. Moreover, we like that KuCoin Token has many identifiable use cases. For example, holders receive discounted trading commissions when using the KuCoin exchange. Token holders also receive a share of exchange commissions via dividend payments. Kucoin Token also offers priority access to new cryptocurrency launches. It can also be staked for additional income. That said, KuCoin Token could be heavily undervalued – with a current market capitalization of just over $420 million. Furthermore, this altcoin is trading almost 85% below its prior all-time high. Those looking for exposure to decentralized finance might consider Aave one of the best altcoins to buy. This innovative project bridges the gap between investors and borrowers; removing third-party intermediaries along the way. Here’s how it works; Suppose an investor has some Ethereum tokens in a private wallet. Rather than leaving the Ethereum tokens sitting idle, they can deposit them into an Aave liquidity pool. In doing so, the Ethereum tokens will be lent to borrowers – who will pay interest on the loan. After a small fee, interest payments will be sent to the original investor. All of this is achieved in a decentralized way, which increases yields for investors and reduces interest for borrowers. Aave is clearly a proof-of-concept, considering that nearly $7 billion is currently locked in liquidity pools. Aave supports multiple blockchain networks, including Ethereum, Optimism, Fantom, Base, and Arbitrum. That said, the project’s native altcoin, AAVE, is currently trading over 90% below its all-time highs. This offers an attractive entry point for new investors. Solana is a large-cap altcoin that has developed a proprietary blockchain. It’s considerably more efficient than Ethereum and can also support smart contracts and dApps. That said, only a small fraction of projects have been built on Solana when compared to Ethereum. For instance, the Solana ecosystem contains just 205 projects. In contrast, thousands of projects operate on the Ethereum network. Nevertheless, if Ethereum isn’t able to improve its efficiency, Solana could increase its market share. For example, Solana transaction fees average just $0.00025. This is the case regardless of how many SOL tokens are being transferred. This makes it ideal for high-volume dApps, such as play-to-earn games or crypto-centric casinos. Moreover, Solana takes just 400 milliseconds to confirm transactions. Another benefit of Solana is that it has a 0% net carbon impact on the environment. While Solana has solid fundamentals, SOL is currently trading over 90% below its all-time high and has struggled to recover from its links with Sam Bankman-Fried and collapsed crypto exchange FTX. Polygon also makes our list of the best altcoins to invest in 2024. In a nutshell, Polygon is a ‘layer 2 solution’ for the Ethereum network. In simple terms, it allows Ethereum-based projects to operate more efficiently. Not only in terms of lower fees but faster transactions. Moreover, Polygon is a lot more scalable, which reduces network congestion. According to CoinMarketCap, Polygon can handle over 65,000 transactions per second. Ethereum struggles to handle more than 30. This is why 214 ERC20 tokens have bridged to Polygon. Its speed and cost-effectiveness are paramount for high-volume dApps, such as Aave, Decentraland, Chainlink, and Gala. After all, these projects need to produce a significant number of transactions. Polygon is currently valued at over $5 billion, so this is one of the largest altcoins for market capitalization and it has partnerships with major global brands such as Adidas, Disney, Reddit, Starbucks and Nike. However, like most altcoins, Polygon has been hit hard by the bear market and its native token, MATIC, is trading 80% below its all-time high. Altcoins are an umbrella term for any cryptocurrency that isn’t Bitcoin. Short for ‘alternative coins’, there are thousands of altcoins in existence. There are small-cap altcoins worth a few thousand dollars, and others with a multi-billion dollar market capitalization. The vast majority of altcoins do not have their own proprietary blockchain. For example, many altcoins operate on the Ethereum network – these altcoins are known as ERC20 tokens. Anyone can create an altcoin, which is why there are so many in the market. That said, some of the best altcoins have a native network that operates independently. For example, XLM operates on the Stellar network, while MATIC is based on Polygon. Each altcoin will have a specific purpose. ETH, for instance, is used to pay transaction fees on the Ethereum network. This means that thousands of ERC20 projects require ETH to function. Then there’s LINK, which is required to deploy Chainlink Oracles. Crucially, although more risky, altcoins generally offer a higher upside potential than Bitcoin. This is because Bitcoin has already experienced the vast bulk of its growth trajectory. After all, Bitcoin is valued at over $500 billion. And at its peak, Bitcoin had a market capitalization of over $1 trillion. In contrast, some of the best altcoins to buy are valued at a few million dollars. This offers investors a significant amount of upside. Sonik is a good example here. If the Sonik Coin presale hits its hard cap target as expected, it will list on exchanges with a market capitalization of just over $4 million. So, even if Sonik generated gains of 100x, it would still be valued at a fraction of Bitcoin. Let’s explore some of the main benefits of investing in altcoins in 2024. We mentioned above that altcoins have a much higher growth potential than Bitcoin. Let’s elaborate on this concept so that you have a firm grasp of the fundamentals. Now let’s compare this to a micro-cap altcoin like Wall Street Memes. This presale project is selling 50% of its token supply and aims to raise just over $30.5 million. It has already raised more than $25 million, so is likely to reach its hard cap target. In turn, Wall Street Memes will be listed on exchanges with a market capitalization of approximately $61 million. At just $61 million, Wall Street Memes has a significant amount of upside potential on the table. For instance, if it increases by 10x, it will only be worth $610 million. If it increases by 100x, that’s $6.1 billion – still just a tiny fraction when compared to Bitcoin. This isn’t just the case with Wall Street Memes, but many of the presale projects discussed today. For instance, Sonik, Launchpad XYZ, yPredict, Scorpion Casino, and eTukTuk will also be listed on exchanges with a micro-cap valuation. Some of the most popular altcoins to invest in have produced unprecedented returns in recent years. While the markets are volatile, those investing from the ground up have generally done well. In other words, altcoins can yield attractive gains for those holding onto their tokens in the long run. Let’s look at some notable examples. In another example: All that being said, not all altcoins will generate returns like Polygon or Solana. Some altcoins will lose value and never recover. This is just the risk that cryptocurrencies in general present. In the section above, we gave some examples of how long-term altcoin investments can yield notable results. However, altcoins can also produce significant gains in a much shorter period of time. This is especially the case with meme coins and newly launched presales. For example: However, the key point is that after hitting all-time highs of $0.000004354, Pepe quickly declined in value. Today, it’s 80% below its peak valuation. As such, the best altcoins to buy for short-term gains will often rise and fall at rapid speeds. So, if you’re planning to adopt a short-term trading strategy, it’s wise to actively monitor the markets and set sensible stop-losses. Knowing when to sell an altcoin investment can be challenging. Not only during rising markets but when prices are declining too. Many of the best altcoins to watch hit all-time highs during the prior bull market – which peaked in late 2021. After peaking, the broader markets went on a prolonged decline. This means that most altcoins are worth a small fraction of their all-time highs. If you’re new to the altcoin market, this is actually a good thing. After all, you’ll be able to buy a portfolio of altcoins at a huge discount. Based on current prices and all-time highs, check out the discounts being offered by the following altcoins: These price reductions are unprecedented, especially considering the quality of each project. But, that’s just the nature of the altcoin industry – it’s extremely volatile. Nonetheless, many investors buy discounted altcoins hoping that they will return to their prior all-time highs. Take Uniswap, Chainlink, and Solana as examples. Considering they are trading at discounts of 90%, a return to prior highs would yield growth of 900%, or 10x. There is no knowing which altcoins will recover their former all-time highs, if any. So the best approach is to invest in a wide range of altcoins. Even if just one altcoin makes a full recovery, this could still generate sizable gains. With so many altcoins in the market, diversification has never been easier. This could give you the best chance possible of choosing an altcoin that goes on to generate gains of 100x or more. Diversification also enables you to reduce the risks of significant loss. To create a diversified portfolio, consider many different types of altcoins. For example, you could allocate 50% of our altcoin portfolio to large-cap altcoins, such as Ethereum and Solana. You can then allocate 30% of the portfolio to mid-caps, such as KuCoin Token and Aave. The remaining 20% could be allocated to small and micro-cap altcoins, like Wall Street Memes, Sonik, and Launchpad XYZ. Unlike Bitcoin, the best altcoins to buy enable you to earn income – this is in addition to price appreciation – through a feature called staking. For example, Wall Street Memes is currently offering staking rewards at an APY of 84%. Although the APY will fluctuate, here’s an example of how it works: Staking is somewhat similar to buying dividend stocks. It’s a great way to increase your earnings while holding onto your altcoins long-term. In addition, some altcoins can be deposited into crypto savings accounts. This follows a similar principle to staking, but your tokens will likely be lent out to borrowers. In contrast, staking rewards are usually provided directly by the altcoin project – as an incentive to hold long-term. It remains to be seen exactly how many altcoins there are in the market. Cryptocurrencies do not trade in centralized markets like stocks – so there isn’t a verifiable database that we can use. On DexTools – which tracks cryptocurrencies listed on decentralized exchanges, there are over 2.1 million altcoins listed. An overwhelming majority of these will be inactive altcoins with no trading volume or liquidity. We mentioned above that there are thousands of altcoins to invest in. And over 2.1 million if using figures provided by DexTools. Either way, this means that choosing the best altcoins to buy can be a difficult task – especially for newbies. Below, we discuss some of the best practices that you can take when building a diversified portfolio of altcoins. Some of the best altcoins to buy are established cryptocurrencies trading at bear market discounts. So, one of the best ways to find these altcoins is to visit CoinMarketCap. This strategy is somewhat manual – but can be worth the effort. For example, consider looking at mid-to-large altcoins that have solid use cases. Examples include Ethereum, Uniswap, Solana, Polygon, and Chainlink. After clicking on an altcoin, look at the left-hand side of the CoinMarketCap dashboard. Scroll down to find the section that says ‘All-Time High’. This provides invaluable information. Not only does CoinMarketCap display the altcoin’s all-time high – but also the date that it was achieved. Moreover, CoinMarketCap also displays the percentage decline from the altcoin’s previous all-time high, based on real-time prices. So, in the example above, we can see that Polygon is trading just over 91% below its all-time high. We can also see that Polygon’s all-time high was hit in November 2021. This is also useful, as this was the period that the prior bull market peaked. As such, the huge decline of 91% is likely because of broader market conditions, rather than any specific issues with Polygon. DexTools is also useful when searching for the best altcoins to buy. This strategy will see you focusing on smaller-cap altcoins that trade on decentralized exchanges, such as Uniswap and PancakeSwap. DexTools offers a lot more features and customization than CoinMarketCap, so there are several approaches that you can take here. If you’re a short-term trader, a good starting point is to check out which altcoins have generated the biggest gains in the prior 24 hours. Click on the ‘More’ button next to ‘Daily Gainers’ to see the full list. The best-performing altcoins will then be listed by their 24-hour percentage gains. Many of the biggest gainers on DexTools have very small trading volumes. These altcoins could be worth avoiding, as you will likely experience extreme volatility. To rectify this, click on the ‘Custom Filters’ button and set the minimum trading volume at $1 million. You might also consider filtering the best-performing altcoins by market capitalization. Once again, it might be worth setting this to at least $1 million. Just remember that the smaller the market capitalization, the higher the volatility. Some of the best altcoins to buy can also be found in the ‘Hot Pairs’ section. By default, this is set to only include ERC20 tokens. But you can change this to other blockchain networks, such as Binance Smart Chain, Polygon, Solana, or Arbitrum. While this shows the most visited altcoin pairs in the prior 24 hours, it doesn’t offer any custom filters. We also found that YouTube can be a superb place to find the best altcoins to buy. There are plenty of reputable analysts on YouTube that have their own channels. Some YouTube analysts cover large-cap altcoins via technical analysis. This looks to find altcoins that could be about to explode based on technical indicators. While others focus on the fundamentals, such as news developments. Altcoin Daily, for example, covers everything from Ethereum and Polygon to XRP and Cardano. This is a great way to keep tabs on trending altcoins and extract valuable information. AltCoin Daily has over 1.32 million subscribers. Alternatively, if you’re more interested in micro-cap altcoins and presales, Jacob Bury’s YouTube channel is the place to go. Although Jacob Bury has just over 21,000 subscribers, he has a tremendous track record. Bury specializes in presales that he believes will grow by at least 10x once the respective altcoin is listed on an exchange. Currently, Bury is recommending Wall Street Memes to his ever-growing audience. In fact, Bury tipped this presale from the very get-go; it’s since gone on to raise more than $25 million. Bury previously tipped the Tamadoge presale, which netted early investors gains of over 20x. Investors should ensure they understand the risks of altcoins before investing in any capital. The main risks to consider are discussed below: Put simply, you could lose some or even all of your investment when buying altcoins. As such, you should never invest more than you can realistically afford to lose. For example, consider an investor who bought XRP in early 2018. In doing so, they would have invested when XRP hit its all-time high of $3.84. More than five years later, XRP has still not recovered its prior all-time high amid an ongoing three-year court battle with the US Security and Exchanges Commission. In fact, today, XRP is trading 86% lower, despite a recent court win that saw the price pump. This means that a $1,000 investment would now be worth just $140. XRP’s situation is even more worrying when you consider that we have since gone through a prolonged bull market. While many altcoins recorded new all-time highs between 2020-2021, XRP remained at just a fraction of its former peak. Altcoins are volatile asset classes. They can rise and fall in rapid pricing swings. As an altcoin investor, you should be prepared for this. For example, you might wake up one morning to see that your altcoin portfolio is up 10%. The following day, you could be looking at losses of 30% – this is just the nature of trading altcoins. This is why it’s important to set realistic goals, understand your own risk tolerance and have a clear exit strategy. For example, suppose you buy Solana because it’s trading at a 90% discount from its all-time high. Consider what gains you would be willing to take, or what losses you would accept. While nobody can predict the markets, smart investors always have a plan. You should also consider risks inside and outside of the altcoin trading markets. For a start, if you’re investing in new altcoins without a solid track record, you’ll need to do some due diligence. This is because some altcoins will turn out to be scams. For example, the altcoin project might make bold promises about its objectives and use cases. But it might never have any intentions of actually following through with any of them. Instead, it might simply look to extract as much capital from investors as possible, before walking away from the project permanently. Another risk, known as a ‘rugpull’, follows a similar concept. This scam is usually deployed via a presale campaign. The project will raise funds from investors and after the presale finishes, completely vanish. This will leave presale investors with worthless altcoins. You should also consider the risks associated with wallet hacks. This can happen if you misplace your private keys, or you unwittingly click on a malware link. Wallet hacks are increasingly becoming commonplace in the cryptocurrency space. So it’s important to understand how to keep your wallet, and altcoins, safe. Altcoins offer a great opportunity to target sizable gains, both in the short and long-term. Even in the midst of a bear market, some altcoins have grown by thousands of percentage points. Still wondering what altcoin to buy? Currently, Smog ($SMOG) is one of the top altcoins. This is a meme coin on Solana that aims to make the greatest token airdrop worth 490 million tokens.

The Best Altcoins to Invest in Shortlisted

Our Analysis of the Top Altcoins to Buy Now

1. Smog – Best Altcoin to Buy With Huge Meme Coin Potential on Solana

Hard Cap

N/A

Total Tokens

1.4 Billion

Tokens available in presale

Not a presale

Blockchain

Solana

Token type

SPL

Minimum Purchase

None

Purchase with

USDT, USDC, SOL or any other Solana-based token

2. Sponge V2 – One of the best Altcoins to Buy Now, With up to 4,000% Annual Yields

Hard Cap

N/A

Total Tokens

150 Billion

Tokens available in presale

N/A

Blockchain

Ethereum Network

Token type

ERC-20

Minimum Purchase

None

Purchase with

USDT, ETH, Card

3. Bitcoin Minetrix – New Stake-to-Mine Altcoin With Real Utility Value Targets BTC Cloud Mining

Hard Cap

$32 million

Total Tokens

4 Billion

Tokens available in presale

2.8 Billion

Blockchain

Ethereum Network

Token type

ERC-20

Minimum Purchase

$10

Purchase with

USDT, ETH, BNB

4. Meme Kombat – Exciting Altcoin Is The First To Offer Meme Vs Meme Warfare With Multiple Betting Options

Hard Cap

$10 million

Total Tokens

12 million

Tokens available in presale

6 million

Blockchain

Ethereum Network

Token type

ERC-20

Minimum Purchase

$10

Purchase with

USDT, ETH, BNB

5. eTukTuk – Building a Green Network of EV Tuk-Tuks in the Developing World

Token symbol

TUK

Presale supply

200,000,000 TUK

Token type

BEP-20

Payment methods

ETH, BNB, USDC, USDT, ADA

Listing price

Not stated

6. Scorpion Casino – Invest in the Future of Online Gambling [Crypto-Centric Casino and Sportsbook Now in Presale]

Token symbol

SCORP

Presale supply

200,000,000 SCORP

Token type

BEP-20

Payment methods

ETH, USDT, BNB

Listing price

$0.05

7. Stellar – Cross-Border Payments Network With Super-Fast and Cheap Transactions

8. Uniswap – One of the Pioneers of Decentralized Trading [Huge Bear Market Discount of 90%]

9. Chainlink – Leading Oracle Technology for Smart Contract Data From the Real-World

10. Ethereum – Powering Thousands of Decentralized Applications Worldwide

11. KuCoin Token – Hugely Undervalued Altcoin Backing One of the World’s Largest Crypto Exchanges

12. Aave – Promoting Financial Freedom for the Masses – Invest and Borrow Crypto Tokens

13. Solana – One of the Most Efficient and Cost-Effective Blockchain Networks Globally

14. Polygon – Layer 2 Solution for the Ethereum Network With End-to-End Gains of Over 12,000%

What are Altcoins? The Basics

What are the Benefits of Investing in Altcoins?

Higher Growth Potential

Some Altcoins Have Produced Unprecedented Returns

Altcoin Can Grow Exponentially in the Short-Term

How do You Know When to Sell an Altcoin Investment?

Most Altcoins are Worth a Small Fraction of All-Time Highs

Altcoins Enable You to Diversify

Where to Buy Altcoins?

Staking Rewards and Other Income Earning Opportunities

How Many Altcoins Are in Existence?

Selecting the Best Altcoins to Invest in

Look for Top-Quality Altcoins on CoinMarketCap Trading at Discounts

Explore Trending Coins on DexTools

YouTube Analysts With Proven Track Records

Risks to Consider Before Buying Altcoins

Your Altcoin Investment Can Decline and Never Recover

Be Prepared for Extreme Volatility

Where Can I Find Altcoin Price Predictions?

Scams and Wallet Hacks

Conclusion

References

FAQs

What altcoins will explode this year?

Which altcoins have 100x potential?

What is the best altcoin to hold 2024?

Which altcoin will make me rich?

What are the top 3 Altcoins?

What is altcoin season?