Coinbase CEO Brian Armstrong has advocated for Bitcoin (BTC) as a financial discipline tool, suggesting it could counteract United States deficit spending and echo the fiscal restraint of the gold standard era.

This is (in part) why Bitcoin matters. It’s a return to the gold standard that we left fully in 1971. A return to financial discipline.

Bitcoin will be an important check and balance on excessive deficit spending which is essential to the U.S. and the dollar remaining strong. https://t.co/u4mN5SgPTX

— Brian Armstrong 🛡️ (@brian_armstrong) March 12, 2024

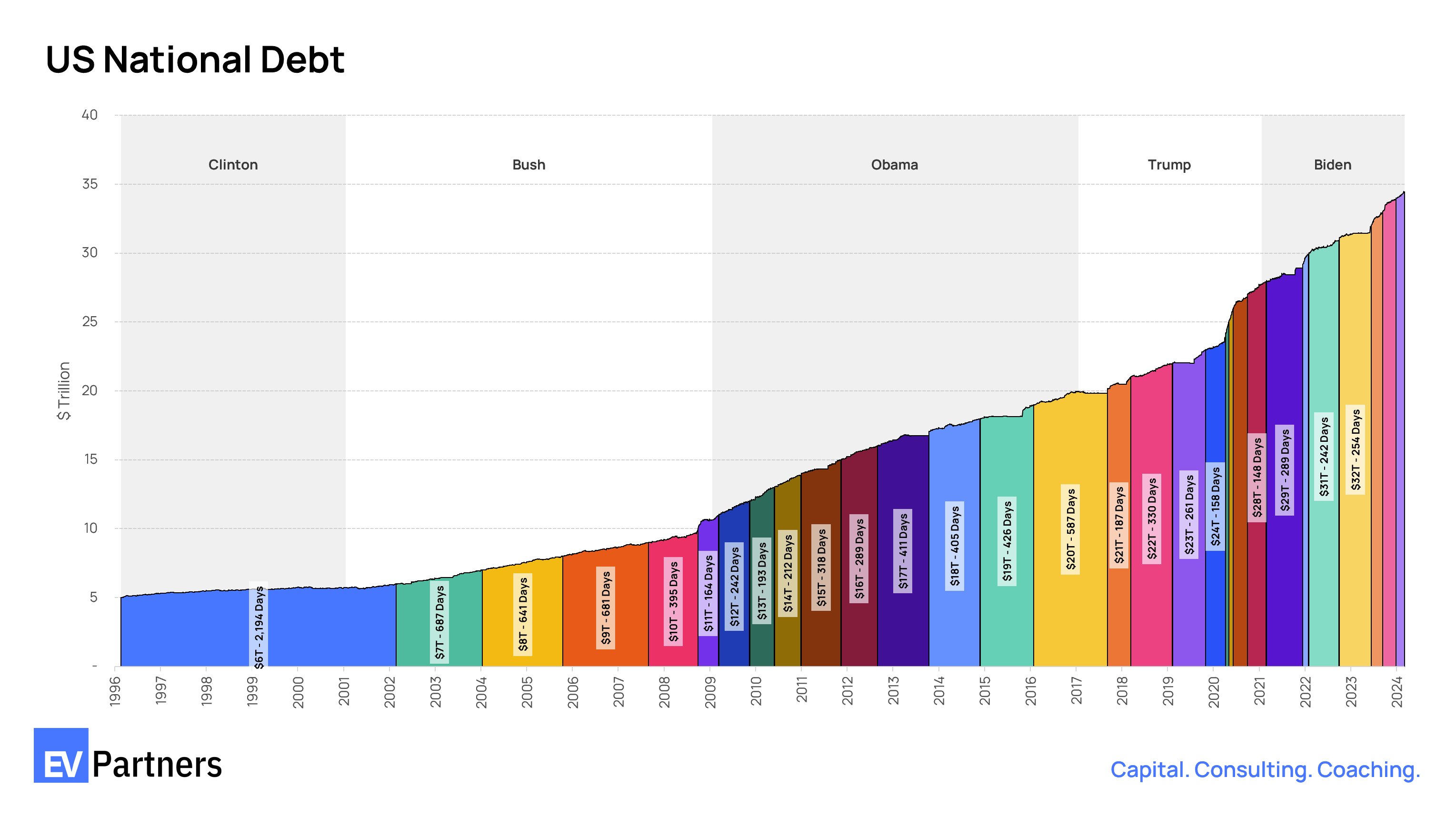

Robert Sterling, CFO of 20 Dollar Consulting, explained that the United Sates national debt is a symptom of fiscal expansion. The trend took hold and started accelerating during the Gerge W. Bush administration and never subsided away since then.

Furthermore, the situation was further exacerbated as a consequence of military spending, tax cuts, the Great Recession and the recent COVID-19 pandemic. Armstrong commented on this trend by advocating for Bitcoin as a possible solution.

Bitcoin: the new gold standard?

The Coinbase CEO suggested the Bitcoin is a return to how the financial landscape looked up to when in 1971 the Nixon administration abolished the gold standard — one of the causes of the so-called Nixon shock. According to Armstrong, the inability of financial institutions to issue more Bitcoin according to their wishes constitutes “a return to financial discipline.”

The Coinbase CEO believes that Bitcoin could serve as a counterbalance to what he perceives as excessive deficit spending of the United States administration. He also claims that Bitcoin could keep the United States dollar strong.

Still, Armstrong did not explain how Bitcoin would strengthen the dollar or act as a counterbalance to United States’ deficit spending. Eric Voorhees — CEO of instant crypto exchange ShapeShift — voiced his confusion concerning how Bitcoin would achieve anything that was suggested by the Coinbase executive.

How does Bitcoin provide a check and balance on excessive deficit spending?

Very long term, when fiat is gone, I can see how, but while fiat is still a thing, does Bitcoin restrain gov spending at all?

— Erik Voorhees (@ErikVoorhees) March 13, 2024

Voorhees has gone as far as to suggest that in the long-term Bitcoin could end up keeping public spending in check. Still, he suggested that this could only happen after fiat currency become a thing of the past. This is in stark contrast with the Coinbase CEO’s suggestion that it could instead strengthen the United States dollar.

The debate follows recent reports that El Salvador — the world’s first country to adopt Bitcoin as legal tender — has seen $84 million in gains from its Bitcoin holdings. The country is also working to launch its “Volcano Bonds” backed by Bitcoin.

Featured Image: Ideogram